2023 Real Estate Market Comparison

While there was positive growth in housing inventory and a return to more moderate prices for housing over the course of 2023, the most significant factor influencing the Houston housing market was mortgage interest rates, which reached a 20 year high last year in some cases exceeding 8%. This was the second year in a row where we experienced a disruption to the housing market on a national scale, which means that at least Houston was not the only affected area. Rising mortgage rates served as a deterrent to many prospective home buyers, causing them to shelve their plans to purchase a home and consider rental as an alternative.

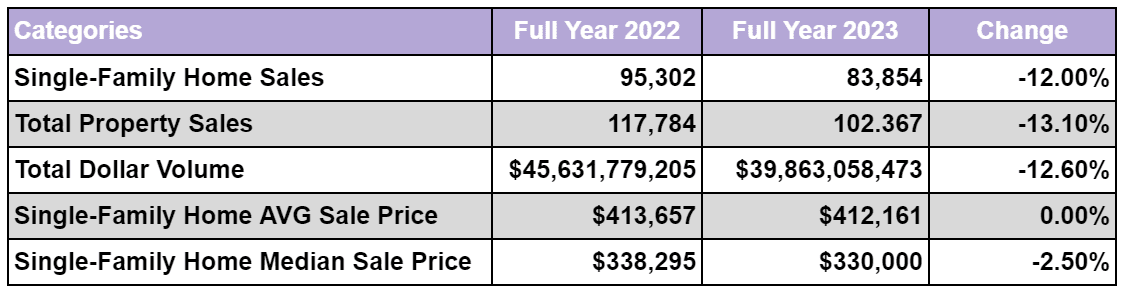

These factors contributed to a decline in annual sales of single-family homes by 12%, sales of all properties by 13.1%, and total yearly dollar volume by 12.6% from $45.6 billion in 2022 down to only $40 billion by the end of 2023. Despite being the second consecutive down year, November experienced the first increase in home sales in 19 months at 4.7%.

The housing inventory recovered significantly over the course of the year rising to a 3.3 months supply of single-family homes and a 3.5 months supply of townhomes/condominiums. This statistic is a good indicator that the market has begun leveling out as supply has risen to better meet current demand for housing. Over 2023, prices stabilized with both average and median costs of a single-family home remaining unchanged from 2022 levels at $407,817 and $330,000 respectively.

Looking for a new home? Check out this delectably spacious, open floorplan of this new construction at 3767 Durness Way.

2024 Real Estate Market Forecast

In an interview with Century 21 Exclusive, HAR Chair Thomas Mouton expressed that he believes “that home sales will pick up once consumer confidence is restored, and that depends on what the Federal Reserve does with interest rates and evidence that inflation is no longer a threat. The expanded housing inventory and moderation in pricing we saw throughout 2023 have created a positive buying landscape for 2024.”

While there are concerns about elevated mortgage interest rates as well as the continued rise of inflation on a national level, 2024 is predicted to experience positive growth overall in Houston’s housing sector. With the housing supply reaching more normal levels, property sales are expected to experience some growth by the end of 2024, however declining trends from 2023 will likely persist through the first quarter.

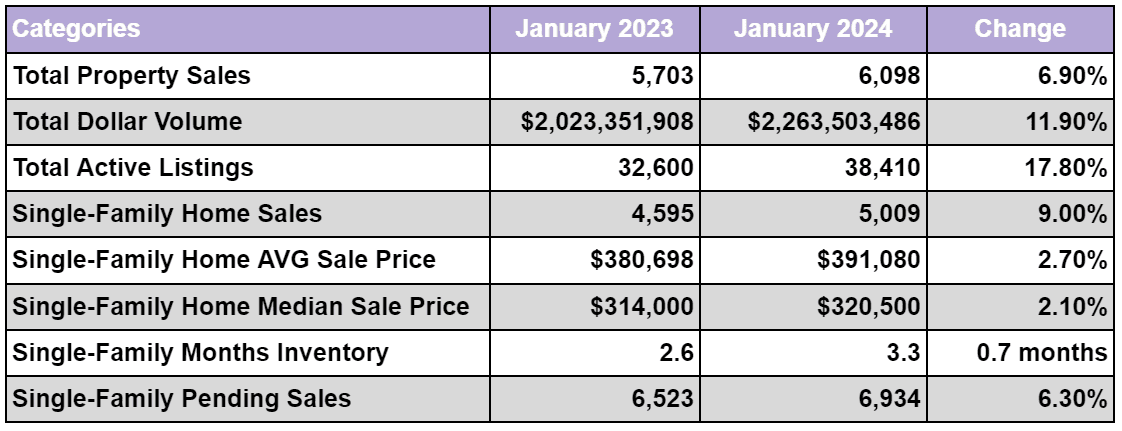

January marked a surprisingly strong start for the 2024 market with an unprecedented rise in single-family home sales of 9% across Greater Houston. This has been one of only two months in over the past 21 where sales have not declined from previous years. The local housing inventory also saw an increase over 2023’s numbers from 2.6 to 3.3 months supply, indicating that the market is shifting back to a more balanced position.

Only sales on listings priced below $150,000 declined in January, with higher price point homes experiencing much higher rates of purchase. Sales of homes priced between $500,000 and $1 million rose a surprising 16.7% year over year, similarly to homes over $1 million which also increased 15.4%. Total property sales rose 6.9% with 6,098 units sold and total dollar volume was up 11.9 percent to $2.3 billion. The average price for a single-family home rose 2.7% to $391,080 from last January, which is still the first time since February of 2023 that the average price has been below $400,000. Townhome/condominium sales continued the declines that prevailed throughout 2023, falling 4%, with the median price up 14.1% to $223,000 and the average price up 7% to $247,437.

This beautiful home on a nearly 10,000 square foot lot at 2754 Shadowdale Drive boasts of its unique arched windows and stunning hardwood floors. It’s sure to sell soon, so view it while you have the chance!

By price point, January 2024’s housing sales performed as follows:

$1 – $99,999: decreased 6.4 percent

$100,000 – $149,999: unchanged

$150,000 – $249,999: unchanged

$250,000 – $499,999: increased 13.0 percent

$500,000 – $999,999: increased 16.7 percent

$1M and above: increased 15.4 percent

“January was an unexpectedly positive month for Houston housing, but we don’t want to get ahead of ourselves because we know that consumers are still keeping a wary eye out for interest rates and inflation,” said HAR Chair Thomas Mouton. “Rental housing is still proving to be a viable option for hesitant buyers as it also had strong activity in January.”

Looking For A New Home?

Check out these active listings!

3767 Durness Way

$1,995,000

4 Bedrooms – 3 Full & 2 Half Baths

4,759 Sqft – Built 2023

126 Amundsen St B

$429,000

3 Bedrooms – 2 Full & 1 Half Baths

1,814 Sqft – Built 2023

2754 Shadowdale Dr

$579,000

4 Bedrooms – 3 Full & 1 Half Bath

9,900 Lot Sqft – Built 1971

5661 Larkin St

$443,900

3 Bedrooms – 2 Full & 1 Half Baths

2,161 Sqft – Built 2003

709 Waverly St

$799,000

3 Bedrooms – 3 Full & 1 Half Baths

1,854 Sqft – Built 2001

5104 Lillian St

$625,000

3 Bedrooms – 3 Full & 1 Half Bath

2,386 Sqft – Built 2003