Special thanks to our guest blogger, Mike McFarland of Legacy Mutual Mortgage for today’s post. Mike is a senior loan officer and a trusted friend who has served of our clients well over the years, and we are thrilled that he agreed to share his expertise on mortgage refinancing.

Refinancing Your Mortgage

By Mike McFarland

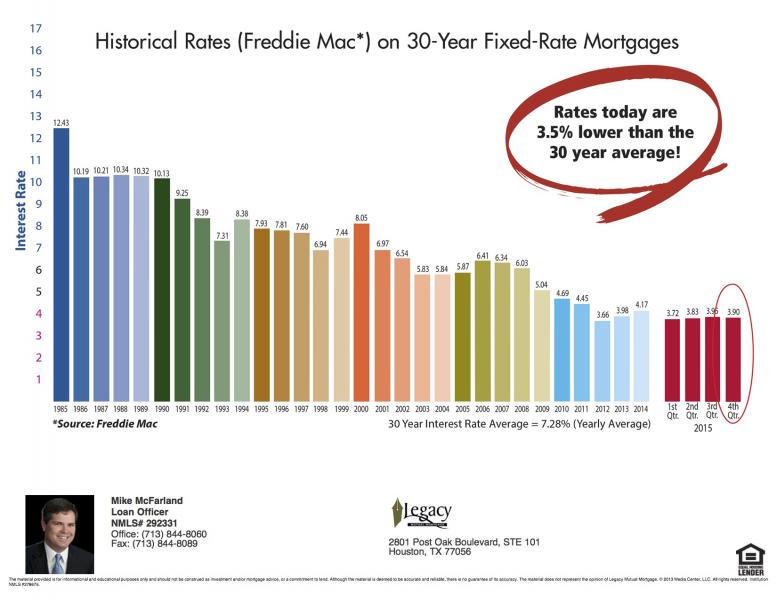

Believe it or not, mortgage interest rates are at the lowest point I’ve seen in the last twelve months, despite the Federal Reserve raising the federal funds rate in December. Now is a good time to consider refinancing your current mortgage.

There are three main reasons homeowners may want to refinance their mortgage. The first is to lower the monthly mortgage payment, the second is to shorten the term of the mortgage, and the third is to tap into the equity of their home.

Lowering your monthly mortgage payment is a great way to free up cash for savings or paying down other obligations. There are several ways to lower your monthly payment in addition to lowering your interest rate. Houston has seen a significant increase in home values in the last five years. If you bought a home during this time with an FHA loan or carrying private mortgage insurance on a conventional mortgage, you could be in a position to refinance to reduce the cost of the monthly mortgage insurance. You will realize significant savings when you couple reduced or eliminated monthly mortgage insurance payments with lower rates. If you financed your home with a second mortgage to avoid mortgage insurance, you can refinance to combine both mortgages to lower your overall monthly payment, and because your home value increased, you would not have mortgage insurance. Additionally, if you acquired a home improvement or pool loan you can combine both mortgages in a refinance to lower your overall monthly mortgage payment. Another reason is to catch up on escrow account shortages, especially in the first quarter of the year when mortgage companies do an escrow account analysis after paying the previous year’s tax bill. An adjustment to your monthly payment for an escrow shortage can increase the monthly payment beyond what is comfortable for your budget.

Shortening the term of your mortgage, i.e. going from a 30 year mortgage to a 20 or 15 year, will turn your mortgage into a savings account. A shorter term mortgage carries a lower rate than longer term mortgages. When you look at an amortization table, you will see huge interest savings with a shorter term mortgage. Additionally, you pay more in principal every month, which means you accumulate equity faster. If you consistently apply additional principal to your payment, either monthly or annually, you should consider refinancing to a shorter term mortgage. Look at your mortgage statement five years after refinancing to a 15 year mortgage and you will be pleasantly surprised at how much equity you have accumulated in such a short time.

Tapping into the equity of your home (a cash out refinance) allows you to pay off debts, remodel your home, finance a child’s education or start a business. Keep in mind we are limited in Texas to 80% of a home’s value to take cash out. For example, if your home is worth $100,000 and there is an unpaid principal balance of $50,000 on the mortgage, you will have $30,000 in equity available for a cash out.

Your mortgage is a financial tool, and it can be used to help you accomplish any number of financial objectives. I offer my clients a free consultation to assess their current mortgage to see how they can potentially benefit from refinancing. Call today before rates go up and the opportunity is missed.