In general, May was an unusual month for the Houston housing market. While the severe weather conditions and power outages caused some impact on closings, consumer demand for homes remained stable. With demand remaining constant, home prices across the Greater Houston area rose to an all time high last month. Another sign that the market is shifting to a more balanced place is the housing supply, which reached its highest point since pre-pandemic levels. Townhomes similarly reached record high inventory levels, while prices increased in each area of the Houston market, and sales declined in every bracket except luxury homes.

Single Family Homes

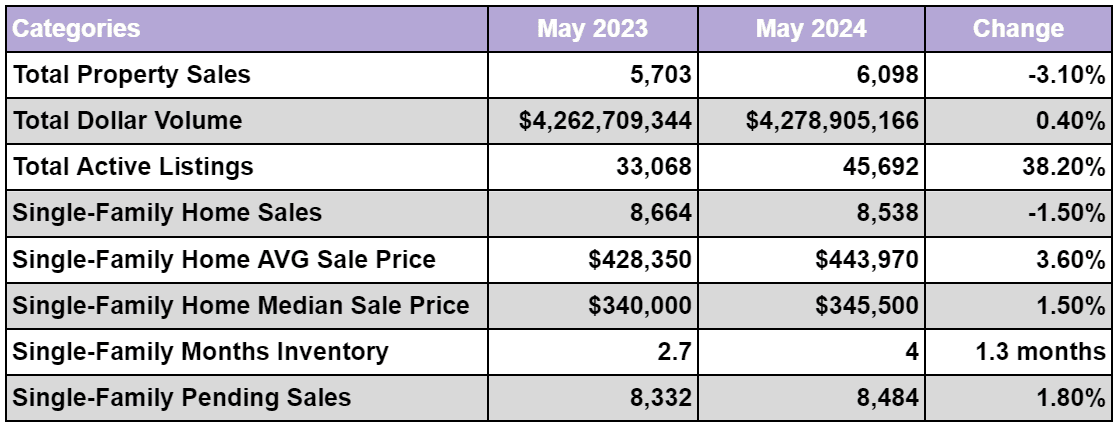

Active listings for single-family-homes increased substantially with 38.2% more homes on the market than May of last year, leading to a significant increase in the housing supply from 2.7 to 4 months supply. Sales of single-family-homes dropped by 1.5% year over year which may have been influenced by the severe storm that occurred in mid May. Despite the decline in sales, the total dollar volume in the real estate market remained consistent at $4.3 billion. This is due to the increases in both average and median home prices that we saw last month. Average prices for single-family-homes rose 3.6% hitting an all time high at $443,970, which broke the previous record from May of 2022. Median prices increased only 1.5% from last year to $345,000.

Looking for a new home? Check out this new listing at 2019 Columbia Street with a luxurious open floorplan and a beautifully done pool.

Townhomes & Condos

The sales of townhomes and condominiums have continued to decline 9.8% from May 2023, but this has not stopped the prices from going up. The median price of townhomes jumped a significant 12.1% to $241,600 while their average prices increased 7.5% to a record high of $281,777. The housing inventory of townhomes and condominiums reached its highest level in the last decade at 4.7 months supply. This is the highest that housing inventory has been since October of 2012, and with the decrease in sales, it is expected that the rising prices will steady or even drop in the future.

Check out this townhome at 5819 Washington Ave B with its spacious master bedroom full of natural light. The location also has great access to popular restaurants!

Overall

By housing segment, May sales performed as follows:

- $1 – $99,999: decreased 6.7 percent

- $100,000 – $149,999: decreased 10.2 percent

- $150,000 – $249,999: decreased 1.2 percent

- $250,000 – $499,999: decreased 2.1 percent

- $500,000 – $999,999: increased 6.8 percent

- $1M and above: increased 9.6 percent

HAR Chair Thomas Mouton commented on the market’s adaptability noting that, “While the weather disruptions may have impacted some sales, there continued to be strong activity with a rise in available listings and persistent buyer interest. We are beginning to see a more balanced market pace, benefiting both buyers with more options and sellers with sustained demand.” With the housing supply resting now above the national average, it appears that the market is sifting as Mouton predicted towards a more balanced position. Generally, 4-6 months supply is considered balanced, while last May’s 2.7 months supply was more in favor of sellers. We can also see with the decrease in the average time homes spent on the market before a sale from 49 to 45 days, that demand has increased from where it was last year, as Mouton suggests.

What Does This Mean For You?

With May being an irregular month due to the extreme weather conditions it’s difficult to say exactly whether sales would have been on the rise without the losses of power and community derailment from the calamity. What we can be certain of is that demand for homes has not subsided, and secondly that supply has increased dramatically. With the increased competition on the market, it is likely that prices will level out somewhat to promote sales during a time of peak demand. The supply increase has shifted the purchasing power back towards the center away from the seller’s advantage of May the previous year. Journeying into the summer, there is a wealth of especially townhomes on the market reaching a 12 year peak, making it likely that prices may be inclined to drop if this trend continues. Otherwise we will likely continue to see reduced rates of purchase in that category. Looking for more information? For further inquiries make sure to contact a trusted agent at Circa Real Estate for professional advice.

Looking For A New Home?

Check out these active listings!

309 East 16th Street

$1,110,000

3-4 Bedrooms – 4 Full Baths

2,217 Sqft – Built 1920

1333 Cortlandt Street

$1,379,999

3 Bedrooms – 3 Full Baths

2,646 Sqft – Built 1910

2019 Columbia Street

$1,999,999

4 Bedrooms – 4 Full Baths

4,149 Sqft – Built 2017

476 Naples Lane

$899,999

4 Bedrooms – 3 Full Baths

3,625 Sqft – Built 2013

1730 W 23rd Street

$849,000

3-4 Bedrooms – 3 Full & 1 Half Baths

3,545 Sqft – Built 2016

1123 Fugate Street

$520,000

2 Bedrooms – 1 Full Baths

1,247 Sqft – Built 1926